Driven by rising affluence, increasing willingness to pay for convenience, rising urbanization, increasing willingness to shop online, and preference for more frequent, unplanned, and top-up purchases, pandemic period confinement consumer behavior has significantly changed in the last few years. A trend that has been accelerated by increased penetration of smart phones and cheap data.

Q-commerce business model is a response to the megatrends. Stastica forecasts the Q-commerce market to generate a revenue of US$3,349.00m in 2024 and exhibit a compound annual growth rate (CAGR 2024-2029) of 24.33%, leading to a projected market volume of US$9,951.00m by 2029.

So what is Quick Commerce?

Quick commerce (Q-commerce) is a business model that emphasizes rapid delivery of products ordered online, typically within a very short time frame after the order is placed. The model is distinguished from traditional e-commerce by its focus on speed, aiming to meet consumers’ immediate needs by delivering products within minutes. Q-commerce is considered the third generation of business models following conventional stores and e-commerce, and it is characterized by its potential for significant market growth

While the core concept of Q-commerce revolves around speed and convenience, it involves the use of “dark stores” or localized warehouses, which are central to its ability to deliver goods swiftly. These are small warehouses of around 400-2000 square meters with around 1000 SKUs (stock-keeping units) or unique products. These stores are only used for fulfilling orders with no regular walk-ins for consumers

Additionally, Q-commerce is a rapidly evolving sector, a disruptive force in the retail landscape, and has potential to reshape market dynamics.

Quick Commerce In India

Redseer in their recent report predicts India will be an exception to the global trend where Q-commerce will be successful and is “set to become a disruptive force, poised to reshape the retail industry as we know it.”

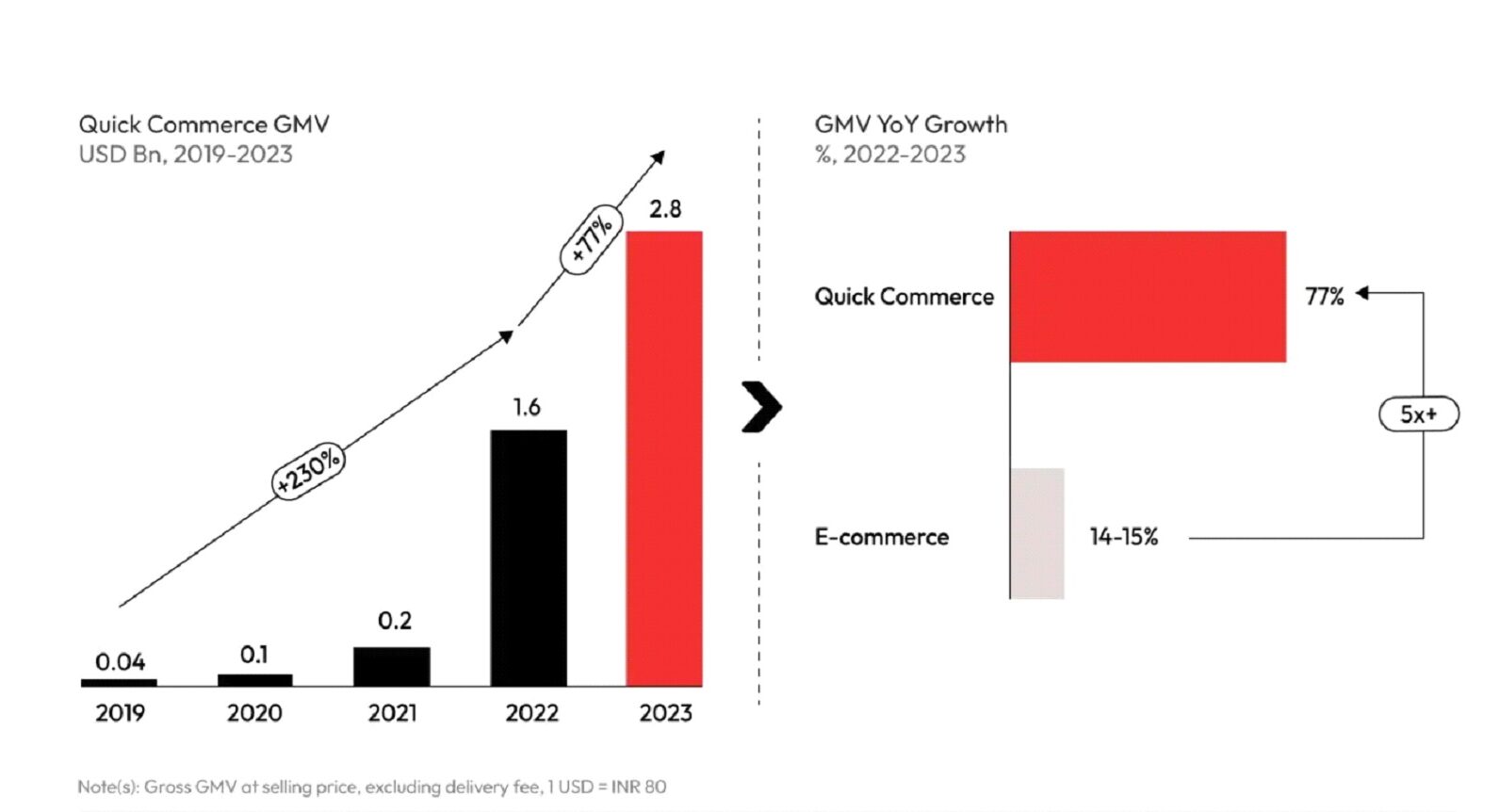

Redseer reports a healthy 77% growth in Gross Merchandise Value between 2022 to 2023, a rapid increase in users adopting Q commerce with Monthly Transactional Users increasing by 46%, Monthly Order Frequency and Average Order value increasing by 6% and 14% respectively.

Q-Commerce GMV Growth

Source: RedSeer https://redseer.com/newsletters/unveiling-indias-q-commerce-revolution/

Source: RedSeer https://redseer.com/newsletters/unveiling-indias-q-commerce-revolution/

JM Financials predicts the exponential scale-up to continue as the model addresses typical urban Indian problem. As per a study by Redseer, approximately 70% of the urban consumer spread is unplanned attributable to the average purchases being small ticket, limited use of preserved foods in India, and limited pantry/storage space in households. Particularly appropriate for high-density, tech-savvy urban neighborhoods the model is likely to be popular in many Indian cities.

Q-Commerce Players

As of 2024, the Q-commerce market in India is described as an oligopoly of four platforms. Zomato-owned Blinkit was the largest player in CY23, with more than two-fifths of the market share, basis GMV. Swiggy-owned Instamart followed it. BB Now being the smallest player.

As of Q4CY23 Blinkit’s market share by GMV is estimated to be ~46% followed by Instamart with 27%, Zepto with 21% andd BB Now with 7% of market share is aggressively trying to expand its market share

Currently the top two players have visibility to profitability. Blinkit’s quarterly adjusted EBITDA losses have come down from INR 3.26bn in 1QFY23 to INR 0.89bn in 3QFY24. As a % of GMV, the losses have come down from -27.8% in 1QFY23 to -2.5% in 3QFY24. The current run-rate of loss reduction suggests Blinkit should be able to break even by 1QFY25, in line with management guidance. Similarly, Zepto’s co-founder Mr. Aadit indicated, in a recent social media post, that the company had reported a 44% YoY improvement in its EBITDA % in CY23. Further, he indicated that Zepto is expected to be EBITDA positive in 2024, indicating a break-even within 36 months of launch.

Quick Commerce and Kiranas

Q-Commerce is fundamentally disruptive and is particularly disruptive to the neighborhood Kirana stores as they service the same need of unplanned, top-up, and urgent purchases delivered to the customer’s doorstep. Q-Commerce players have some advantages that help them gain an advantage over Kiranas

⦁ Larger Assortment – a neighbourhood Kirana shop carries approximately 1500 SKUs whereas QC platform typically carries more than 6000 SKUs which ensures higher customer satisfaction.

⦁ Larger Discounts – most purchases at a neighborhood store are at maximum retail price (MRP) considering the supply chain structure and the margin structure on grocery products where store owners have very little leeway to offer discounts. Since QC platforms operate on a much larger scale they are better placed to leverage that strength to build direct relationships with brands/distributors and bypass the complex/multi-player supply chain structure

⦁ Loyalty Program – Some QC platforms also run loyalty programs in which customers can get incremental discounts, delivery fee waivers, cash-backs, etc. for a nominal membership fee.

Kiranas are responding to the Q-Commerse platform by developing their program which includes one or multiple of the following strategies a.) ensuring deliveries are completed within 30 – 45 minutes, b.) adopting the latest payment mechanisms such as UPI, c.) working with distributors to digitize supply transactions, d.) using simple technologies such as WhatsApp business, e.) build customer relationships. According to a study by Grand Thorton Bharat by adopting these practices Kiranas have improved their revenue by 7 -10% without a significant increase in costs

Conclusion

Q-Commerce has experienced a comeback and is now experiencing rapid growth in Indian cities driven by customer demand for on-demand shopping and convenience supported by smartphone penetration. The market has consolidated, and the top players are rapidly approaching profitability.

The Q-Commerce companies pose a significant threat to the neighborhood Kirana shops as they compete on parameters critical to Kirana survival and Kiranas must adapt to find cohabitation space. As we progress with the research, we will try to develop approaches that can help Kiranas cohabit with Q-Commerce companies. The future posts address digitization of supply and delivery processes, analytics to enhance assortment selection and customer relations, and would identify case studies of successful cohabitation

We will love to engage with you please comment on this post and share it with your friends. If you have a success story or innovative approach that has helped your Kirana store thrive in the face of quick commerce disruption, we’d love to feature your story. Contact us at info@kiranamitr.in